Investor Relations Practice

Vallum specializes in building and developing best-in-class investor relations programs that increase awareness and engagement with coverage analysts and the institutional investment community.

We serve companies that are currently listed as well as those in the registration process. Each program is tailored to the objectives of your management team and is led by a seasoned investor relations and capital markets professionals with a deep knowledge of your industry.

Some clients prefer that we become an embedded member of the organization, managing all aspects of the investor relations function, while other clients use our services to support an existing, in-house team. Our expertise spans both the equity and debt capital markets, ensuring effective communications across even the most complex of capital structures.

Services Include

Connect with our Investor

Relations Leadership Team

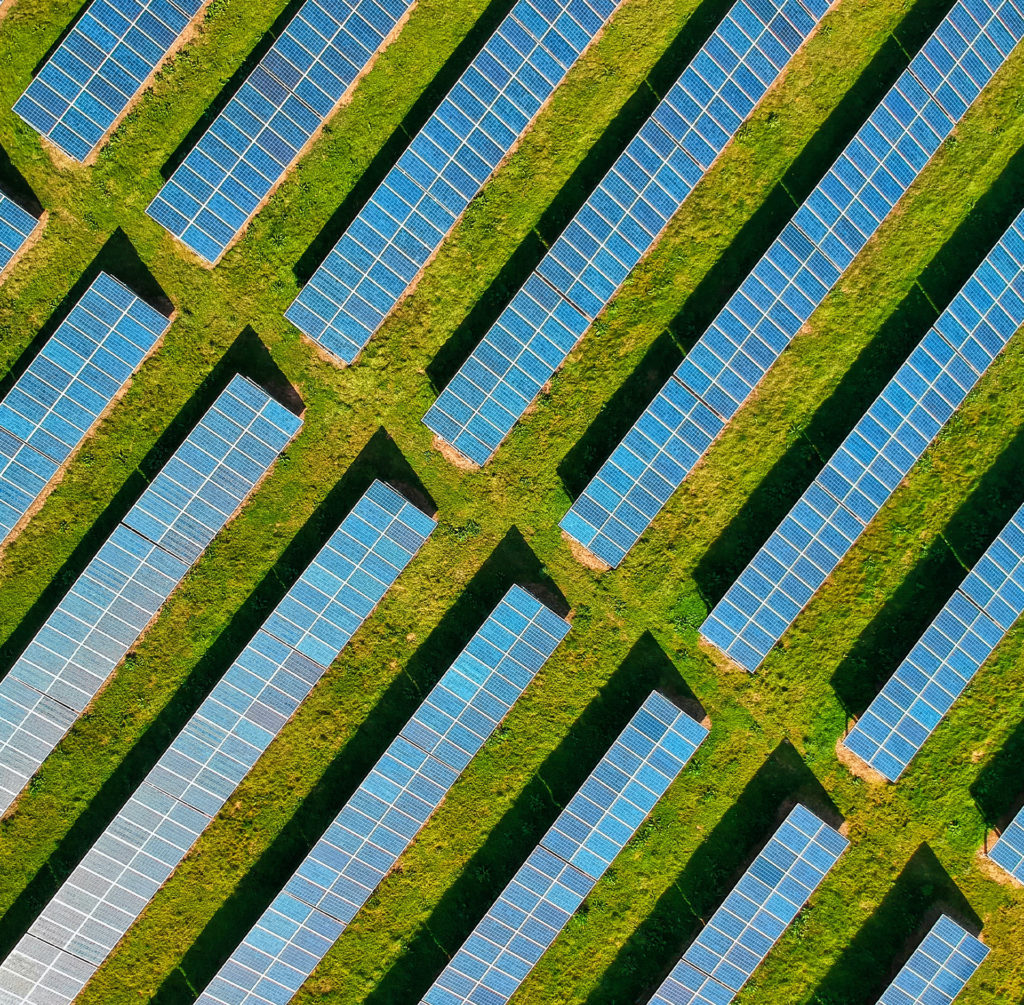

Environmental, Social & Governance (ESG) Practice

At Vallum, we believe that a robust ESG reporting function is an integral part of an effective investor relations program. During the past five years alone, it is estimated that global ESG-focused assets under management increased by nearly 35% to $30 trillion, representing a significant pool of potential fund flows for qualifying issuers. Looking ahead, we expect this trend to continue, particularly given the positive correlation between good corporate citizenship and long-term economic returns.

For companies seeking to screen positively into ESG-sensitive portfolios, the scope of public disclosure has grown to include a wide range of non-financial performance metrics that assess enterprise risk. In recent years, the focus on ESG metric standardization has made significant progress, as several well-established disclosure frameworks such as the Global Reporting Initiative (GRI), Sustainability Accounting Standards Board (SASB) and the Task Force on Climate-Related Disclosures (TCFD) have provided public companies guidance around materiality. Over time, we expect ESG reporting to become compulsory, as regulators adopt uniform standards for non-financial ESG metrics.

Services Include

Connect with our ESG

Leadership Team

Crisis & Reputation Practice

At Vallum, we believe competence, clarity, timeliness and targeted engagement drive effective crisis communications.

Some of our client engagements begin with crisis preparedness through the creation of a custom set of holding statements, stakeholder contact lists and mock crisis preparedness sessions, while other engagements require that we help our clients navigate the complex, high stakes nature of a situation in real-time.

Whether your crisis preparedness is best-in-class or in its nascent stages, we have the experience, resources and contacts to respond accordingly, protecting your brand while maintaining the trust of your investors, customers, employees, regulators and the communities you serve.

Select Scenarios

Connect with our Crisis &

Reputation Leadership Team

Activism Defense

Practice

Last year, we estimate that there were 365 activist campaigns waged against U.S. based public issuers, with approximately 1 in 4 campaigns led by first-time activists. Approximately 70% of these campaigns involved a proxy fight, with activist winning approximately 47% of the time.

Although many of these campaigns were led by a select group of large, well-known activists, increasingly, we have seen smaller hedge funds join activism syndicates as a means of effecting change. It is not unusual for one activist to wage multiple campaigns in a given year, depending on the depth of resources available to them. While most activist campaigns target companies with capitalizations in the $1 to $10 billion range, companies in all market capitalization ranges are potentially susceptible to activist engagement, as illustrated by several high-profile campaigns in recent years.

We advise our clients’ management teams, including their Boards of Directors, on a wide range of activism defense strategies. We understand the tactics used by activists and how best to respond, depending on the circumstance. Some campaigns are characterized by a slow paced, more suggestive approach, while other campaigns move quickly, aggressively and publicly. In contested situations, we provide our clients with a coordinated, multi-channel activist response program, one in which we draft response letters and defense presentations, while conducting investor perception studies and media interviews. In the court of public opinion, we vigorously defend the interests of our clients, their approach to managing the business, as well as the long-term opportunities for value creation evident in this approach.

In recent years, activist preparedness has become a priority for Boards of Directors seeking to mitigate the reputational risk that may result from an activist campaign. Vallum assists companies with activist preparedness through communications audits, vulnerability assessments, management trainings and the production of collateral materials that could be used in the event a company were targeted by one or more activists.